GST is a single tax payable on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

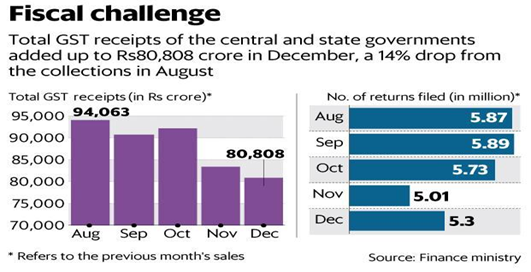

GST rate cut, and lenient implementation of the tax reform has caused GST collection in December 2017 to slip to Rs 80,808 crore, down 14% from August and 3% from November 2017. The number of GST returns filed has also fallen to 5.3 million in December from 5.87 million in April.

This was lower than expected GST collections, along with the extra spending that Parliament approved earlier this month involving a net cash outgo of Rs33,380 crore, are set to put pressure on the government in its efforts to limit this year’s fiscal deficit to 3.2% of gross domestic product (GST), a target set in February. On 10 November, the GST Council slashed tax rates on a large number of daily-use items in the highest slab of 28%. These reductions alone are expected to result in a revenue loss of about Rs20,000 crore a year.

Niti Aayog recently said that due to an efficient tax system post-GST, tax revenue is expected to grow to Rs 26.48 lakh crore by 2019-20 from Rs 17.03 lakh crore in 2016-17. It predicts a 14 per cent growth in 2017-18, followed by 16 per cent and 17 per cent in the next two financial years. Niti Aayog's the three-year action agenda expects the gross tax revenues to GDP ratio to increase to 12.3 per cent by 2019-20, compared to 11.2 per cent in 2016-17.

Courtesy/By: Jalaj Mahajan

|

17 Jan 2018